Slack published its first results since going public, forecasting higher than expected losses. Why are they higher than expected? Is it because they know what they’re doing or because they don’t? The shares fell 15%, which suggests that some decided that it’s the latter. (CityAM)

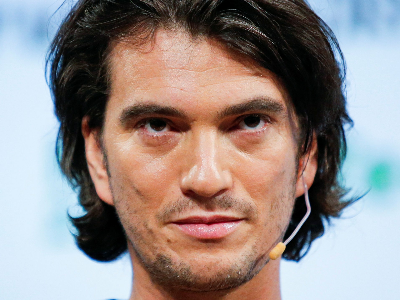

Elsewhere, we now know that WeWork Is the Most Ridiculous IPO of 2019 (Forbes). Little looks new: they’re just doing flexible office space, which has been around for simply ages. Crunchbase says they’ve raise $12.8bn so far – Series H – and their recent IPO prospectus warns: “We have a history of losses and, especially if we continue to grow at an accelerated rate, we may be unable to achieve profitability at a company level … for the foreseeable future.” (Guardian) There’s a great deal of scepticism in the business community about the whole thing (MotleyFool). It even looks as though there’s uncertainty at their cornerstone investor, SoftBank (Bloomberg).

The cash has gone and what’s left?

The cash has all gone out to suppliers, staff and founders, so we know that at least they’ve all benefitted, (Techcrunch) but is it a business or just a way to get rid of investors’ money? “The Internet is God’s way of giving investors’ money to PR companies”, as Elderstreet said back in the heady days of the run-up to the Dot.Com boom. You can dress up what they say, but it looks as though they’re using any and all tactics, including outspending everyone else, to be the winner that takes all, some say like the Robber Barons of the 19 Century (NY Post). Of course a parallel strategy could be simply to inflate the value of the Neumanns (Observer.com).

Losses can be a weapon, too

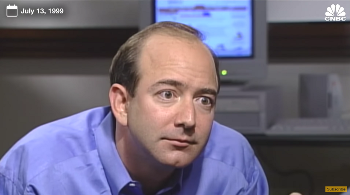

One thing we do know is that their strategy is not about being profitable any time soon – their losses tell us that, big time. Amazon is using losses as a strategic weapon, too. From the outset it trained its investors to expect no profits, and now it’s able to use this as a huge differentiator against all other retailers who must make profits (CNBC). Bezos is more subtle, perhaps, and looks a lot more cunning. He’s more straightforward too, for all that, and isn’t relying on preferential voting rights to protect himself, or self-serving metrics like “Adjusted EBITDA including non-cash GAAP straight-line lease cost” to cloud what’s going on.

Netflix, too, is using the same Outspend Strategy, it seems, and you could argue the same is true at Uber, or was. What’s different among these examples of Losses as Strategy, is the reactions in the wider world. Almost everyone fears Amazon or at least respects them, but let’s say that this is less true about WeWork. Netflix stock took a beating in July when it was reported that subscribers in the USA declined for the first time (WSJ).

Probing this further, it does rather look as though the strategy of WeWork and others is to spend big and run losses, in the hope that size and believability will come before investors’ patience runs out, but without an obvious business model that’s viable. That doesn’t look like the plan over at Amazon, where there seems to be much greater care and precision in execution, and they appear to have sustainability fully under control. It looks as though there’s always been strategic intent (YouTube). Well, yes, they’ve also got the rude health of profits at AWS, of course (ZDNet)

Is strategic intent behind the attitude of investors to losses? Must be, unless they’re mislead, of course. Just after closing my first round of VC investment in 1985, our accountant inisted on meeting the investor to make sure that they realised they’d bought into a company making losses. My investor reacted with some force: “Why on earth would I invest in profits?” – she and I were of the same mind that profits should come later. I changed the accountant, not the investor.

As with another business I work with, we decided that the priority was market growth. Is that like WeWork? Well, maybe. The difference has been that our business model demonstrated its inherent profit potential very early on: costs of sale were stable and gross margins strong and without resorting to defining our own accounting metrics, like “Community Adjusted EBITDA”. Our investment was descrete and easily identifiable, and we had no controversies with our investors. Not on that score, at least.

Losses happen, though, don’t they?

Of course, losses may simply be the result of poor execution or unaddressed issues, and that is going to be the case in many instances but isn’t hard to expose. These are often situations where issues have overcome strategy; as John Lennon said: “Life is what happens to you while you’re planning to do other things”. So losses, here, point to a disconnect between strategy and action, either because strategy was never really a driver of behaviour, or because Management was overtaken by events. Losses point to the need to understand whether they are intentional or not, and why.

All stakeholders should ask searching questions about losses, observers too. Losses are far more revealing than profits, although profitability can point to strategy, too. I recently encountered a business making 45% net margins in a big market opportunity. Needless to say, a little bit of investigation uncovered a strategy that militated against growth.

Losses are a rich seam to explore for anyone who wants to understand what’s going on among the decision makers in a businesses. Sometimes they point to great care, sometimes to wild abandon, even duplicitous behaviour, and often to straightforward, common or garden chaos. It’s always worth finding out which.

Also:

Blog WhatsApp scuppers the B2B market

Blog Are humans the ultimate differentiator?

Blog Why The Big Short was about entrepreneurs

and Interesting Reading

Peter is chairman of Flexiion and has a number of other business interests.