Who needs another set of forecasts when 2020 looks like it’s largely a done deal? Like most decision makers, I’m sure, I’ve already got a plan for much of 2020, so we’re now into executing plans and forecasts are a bit late. I don’t find many of them are that helpful, either, what with one commenting that “blockchain is on the way back”, and another that “at least one big company will fall foul of excessive belief in an algorithm”.

So with the race of 2020 about to begin, here are the five planning assumptions I’ve used for the year ahead.

1. The Global backdrop is set for more instability

The T Person will be reacting to impeachment and the November election, and so there will be plenty of grandstanding. This will feed into trade tensions and other uncertainties. In the UK, the election at least tells us where the uncertainties are around the B Word. It remains to be seen whether Westminster is full of more heat than light, but at least decisons are being made, for good or ill, with announcements of major efforts to re-boot economic activity.

The T Person will be reacting to impeachment and the November election, and so there will be plenty of grandstanding. This will feed into trade tensions and other uncertainties. In the UK, the election at least tells us where the uncertainties are around the B Word. It remains to be seen whether Westminster is full of more heat than light, but at least decisons are being made, for good or ill, with announcements of major efforts to re-boot economic activity.

It’s hard to visualise the year ahead passing without some trigger point being reached in Hong Kong, and that will create big swings in expectation and emotion around relations between China, the EU and USA. Equally, the EU has it’s own internal flashpoints in Paris, between France and Germany, and around the periphery. We can expect FX markets to be something of a wild ride.

2. Business people want to get things done in 2020

I’m fortunate to have a fairly wide network of friends and contacts among businesses, investors, entrepreneurs and commentators, and the common messages I’m hearing are about eager ambitions for real action and achievement in the new year.

For some, 2019 has been a frustration, which is the spur to get things done. For others, the driver is that 2019 was on a good trajectory that they’re keen to ride, ending the year at a fast clip, doing more business than expected and beating targets. I’ve heard stories of solid recruitment activity, too, which is always a leading indicator.

For some, 2019 has been a frustration, which is the spur to get things done. For others, the driver is that 2019 was on a good trajectory that they’re keen to ride, ending the year at a fast clip, doing more business than expected and beating targets. I’ve heard stories of solid recruitment activity, too, which is always a leading indicator.

This sense that decision makers want results is also coming from surveys of attitudes and intentions that I’ve seen recently. Business customers are looking for what will bring them credible, real benefits in the near-term, and this means that those of us with propositions to market must arrive with succinct and believable evidence that we can deliver tangible value. I know we always should do that, but there are times when people are open to more speculative initiatives, and this is not one of those. Just look at the divergence in attitude to tech among investors.

3. Investors will still be hard to get during 2020

2019 has been tough for fund raising. Entrepreneurs I’ve been listening to have found it tough, tougher than for some time. Fund managers have also found it really hard to get their own investors to pony up. Across the board it’s been hard to get decisions made.

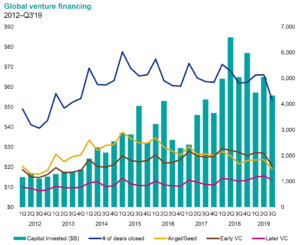

At the start of the year it didn’t seem like it would be that way, particularly with all the high profile stuff in the press. The Billions & Quillions Sqaud were going gangbusters; WeWork was still defying gravity, mostly because Masayoshi Son was spraying cash everywhere, but the wheels come off that as it did for Woodford. The slide began in the Summer, Wework imploded in September, and it’s been descibed as The year the markets stopped believing in unicorns. Good. The above graphic from FT.com shows it well.

At the start of the year it didn’t seem like it would be that way, particularly with all the high profile stuff in the press. The Billions & Quillions Sqaud were going gangbusters; WeWork was still defying gravity, mostly because Masayoshi Son was spraying cash everywhere, but the wheels come off that as it did for Woodford. The slide began in the Summer, Wework imploded in September, and it’s been descibed as The year the markets stopped believing in unicorns. Good. The above graphic from FT.com shows it well.

This chart of VC deals from KPMG shows how the Dollar value and the total number of deals has been sliding across the board, with a sharp downspike after the Summer. It’s doubtful whether this investor trend will turn anytime soon.

4. Data and control of data will be unstable battlegrounds

There are some big drivers swirling around all aspects of data, right now, and these will continue to be battlegrounds in 2020, with implications for many decision makers whose organisations handle the stuff.

There are four main drivers of the things we’ll see in the headlines and have to react to in 2020:

- Data protectionalism – Global trade tensions and inter-state competition are finding ready weapons in control of data at rest and on the move. At best this kind of rivalry looks somewhat peripheral to those of us busy trying to achieve lower down the mountain in the rough and tumble of ordinary commerce. At worst, it creates yet more rock in the road to complicate strategy and execution, particularly for anyone with international ambitions. None of this will let up in 2020.

- Ethical debate – The climate of debate is moving on from discussion of potential issues, to one about action. Fake news, fakery in general, hacking and leaks, who should and should have access to what – all these are almost settled debates, now, and public opinion and regulatory actors are more definite, insistent and determined. Companies are scrambling to avoid losing the initiative, and this will be the environment for most companies working with data in the year ahead.

- State control – Many states are flexing their muscles, sometimes in offensive moves, often in an effort to retain credibility with electors, and sometimes to control their populations. Besides the usual suspects of China and Russia, India and California are in this group now, and Margarethe Vestager looks like a formidible force with a very powerful mandate and the machine to back it up. Fireworks, a shifting playing field, rocks in the road – pick your analogy for 2020.

- Corporate action – Lastly, companies will react to all this, and their reactions will matter, whether they’re the customers or the vendors we deal with. As with state interventions, the impact of corporate action will be abrupt and disruptive for those of us working in and around data, compute and networking. Seasoned decision makers worry about concentration of risk and prize the flexibility to be pragmatic, and have this baked into their business models. The coming year will provide plenty of opportunity to find out who’s ahead of the game.

5. Strategy will matter in this fast moving climate

Rapid change and unpredictability separates the pack into those with the preparation, flexibility and presence of mind to be able to respond and achieve, and those who have to react on the fly and hope to survive. In my experience there are few things worse in the C Suite than finding out you’re not really in control of events, but they control you. Having been in that position at the very start of my business career, I’ve made it my mission to devise strategy to maximise my chances of winning, almost regardless of events.

If we have our strategy right, then the choice of tactics and timing is ours. We called the second half of 2019 correctly in all the major aspects, and came in ahead at the margins. The only variance to expectation came in a slight and inconsequential delay to timing because we found opportunities to go for improved quality. I am certain that events in 2020 will prove to be a robust test of our strategy.

Also

- Other topics: Strategy Insights, Trends and Opportunities

- Blogs on: Strategy, Trends, Management, Executing, Entrepreneurs

- And: Interesting Reading

Peter is chairman of Flexiion and has a number of other business interests. (c) 2019, Peter Osborn