Most organisations now live in the digital world and many connect, store and process data and information, and run their operations in Cloud and other IT infrastructure. Usage is accelerating and causing important business issues and challenges.

Most organisations now live in the digital world and many connect, store and process data and information, and run their operations in Cloud and other IT infrastructure. Usage is accelerating and causing important business issues and challenges.

2024 is shaping up to be a year of opportunity and challenge for firms using Cloud and connected infrastructure. The opportunities go with the huge amount of change around us but that changing landscape also creates challenges.

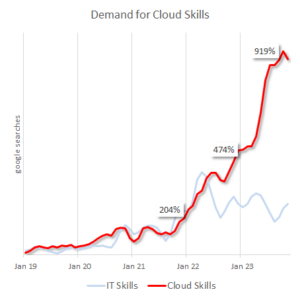

At the start of 2023 we wrote about the accelerating demand for Cloud skills as firms increasingly depended on operational infrastructure for their businesses to deliver every day and on the people to manage it . Now look at it! Demand is running at full tilt and is starting to obey Moore’s Law – doubling every year.

| C-Suite decision makers need to understand what’s happening among Cloud vendors and elsewhere, and why the shortage of skills and manpower creates challenges and impairs their ability respond to business needs and objectives. |

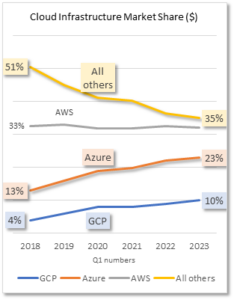

Complexity and rivalry are everywhere. The market is now highly concentrated. AWS not grown at all while Azure has consistently won market share. Google has more than doubled its share but is still a footnote. Others like IBM, Oracle and Alibaba are almost nowhere to be seen and fast losing ground.

Cloud users suffer in markets like this where a small number of very big suppliers control pricing and services. Dependent firms would be wise to note and respond to these business risks .

Cloud users suffer in markets like this where a small number of very big suppliers control pricing and services. Dependent firms would be wise to note and respond to these business risks .

Regulators are now weighing in and may force change , but that and, competitive behaviour among the leaders , just create yet more uncertainties and risks about the future for dependent businesses and their decision makers.

Recent changes in pricing for Cloud services are adding to the challenges of complexity for firms dependent on Cloud and other infrastructure.

Cloud vendors of all sizes have delivered significant changes in prices and price structures:

- Euro prices are up 11%, UK prices by 9-15%

- Complexity creates a fog of uncertainty and intentional inflexibility

- Big increases hide inside all the detail

- Shock increases of 3-25%

The issues are all round: opaque and rising costs, system complexities and business drivers put pressure on teams who are already over-stretched and maybe missing deep Cloud and infrastructure skills and experience. Double-digit price increases combine with structural changes and make it hard to foresee how costs increase and change in response to usage.

| The market among providers of Cloud infrastructure is highly concentrated, unstable and unpredictable, with obscure pricing, and volatile and unpredictable price and service structures. Predatory behaviour and potential regulatory action, as well as regional protectionist behaviour towards data add to the range of uncertainties. |

Independence and flexibility are the Gold Standard objectives for decision makers – independence to avoid being trapped by any one vendor, and flexibility to move workloads where services and prices are best suited to their objectives. Above all, leaders should have full freedom to make whatever decisions are required in these turbulent times.

Lock-in is commonplace among the main vendors in their scramble for market share. All sorts of techniques are deployed and the actual impact of many can be hidden by the complexity of billing and the way price varies with increased usage. Decision makers must tread warily and understand what the future will look like before they commit to any innocent looking choice.

| Business leaders need to understand the many business implications of decisions about Cloud and IT infrastructure, as they would about any resource the firm depends on for its future. |

Portability is a business choice not just a matter of technology. Most well designed systems can be made portable between infrastructure vendors, but the enticing technical services on offer are often attractive development short-cuts that actually conspire to undermine the ability to leave and move to another Cloud provider.

Interoperability is discouraged because Cloud vendors want to keep their customers, and the design of their services becomes another way of frustrating firms’ flexibility and freedom to make changes in pursuit of their business objectives.

Organisations are failing to realise the potential of Cloud. More worryingly, many are also running increased risks of security breaches and regulatory non-compliance because their teams are over-worked or missing the right skills: putting off until tomorrow the things that should have been done yesterday.

Recent reports show that 43% of organisations have fallen behind on compliance and security in the last year due to the cloud skills shortage. A lack of the right manpower resulted in 41% of firms experiencing app performance issues and outages that ought to have been avoided.

The up-surge of interest in AI makes this situation doubly difficult for tech based firms, because it creates yet another tough pressure on payroll and increases the demands made of infrastructure.

As a result, two main areas of risk predominate for decision makers :

- Unmanaged security perimeter – system complexities and sprawl all increase the perimeter that must be managed and the potential exposure to outside attacks that often use sophisticated techniques to find vulnerabilities

- Human error and mis-configuration – the increasing use of new and unfamiliar techniques, features and complex architectures conspire to create performance bottlenecks, and cyber security risks that go unseen until a breach occurs.

Shortage of experience, skills and time lead to a bias towards what’s familiar, not what’s best, and embed a resistance to the flexibility required to incorporate novel approaches that navigate successfully through the business implications, enhance security and unlock cost efficiencies and other business benefits.

The winners will be independent and agile firms who are best able to navigate these uncertainties, risks and complexities. Staying independent of any one provider is key to avoid being trapped into behaviour like predatory pricing and changes to the way that services work or are discontinued , as has happened .

|

This is a tough balancing act for decision makers in busy firms who are using Cloud and other connected infrastructure to deliver on their business ambitions:

The tension between the skills gap and the increasingly specialised demands of Cloud infrastructure can lead to:

|

Management is forced to make decisions by an increasing workload and support issues that stretch the team:

Increasing payroll would:

-

- load up the budget and risk undermining financial objectives

- reduce business flexibility and scalability

- be impractical for people who are needed only occasionally

Not easing the pressure would:

-

- risk over-stretching the team

- risk missed business deadlines and objectives

- put at risk business operations, compliance and cyber security.

C-Suite decision makers must manage these tensions and pressures. Building a clear view of the workloads and their value can show how resources can be focused to deliver solutions and significant business advantage.

| Core: Business specific expertise & IP |

Non-core: Generic tasks, projects & skill bursts |

|

|

|

|

| Delivered by: Internal team | Delivered by: Managed Cloud partner | |

|

|

| The classic business strategy for the C-Suite to use to secure value, independence, scalability, and agility of decision making is:

1. Hoard all core strategic business-specific expertise and proprietary IP, and 2. Push non-core tactical tasks, one-off projects and temporary bursts of effort to a specialist outsource partner |

Peter is chairman of Flexiion and has a number of other business interests. (c) 2023, Peter Osborn